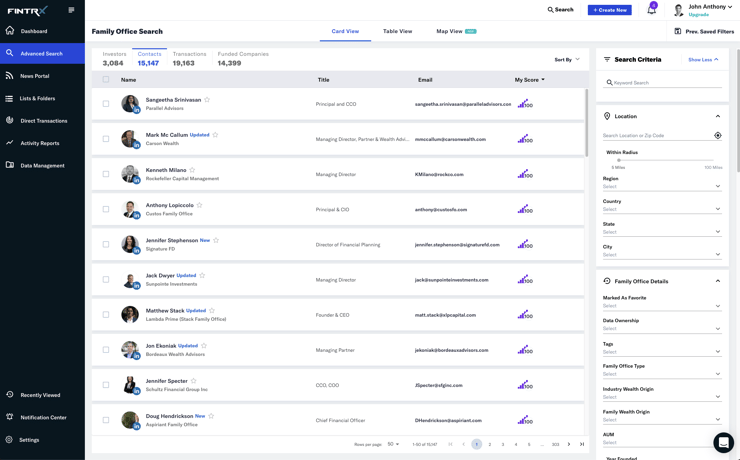

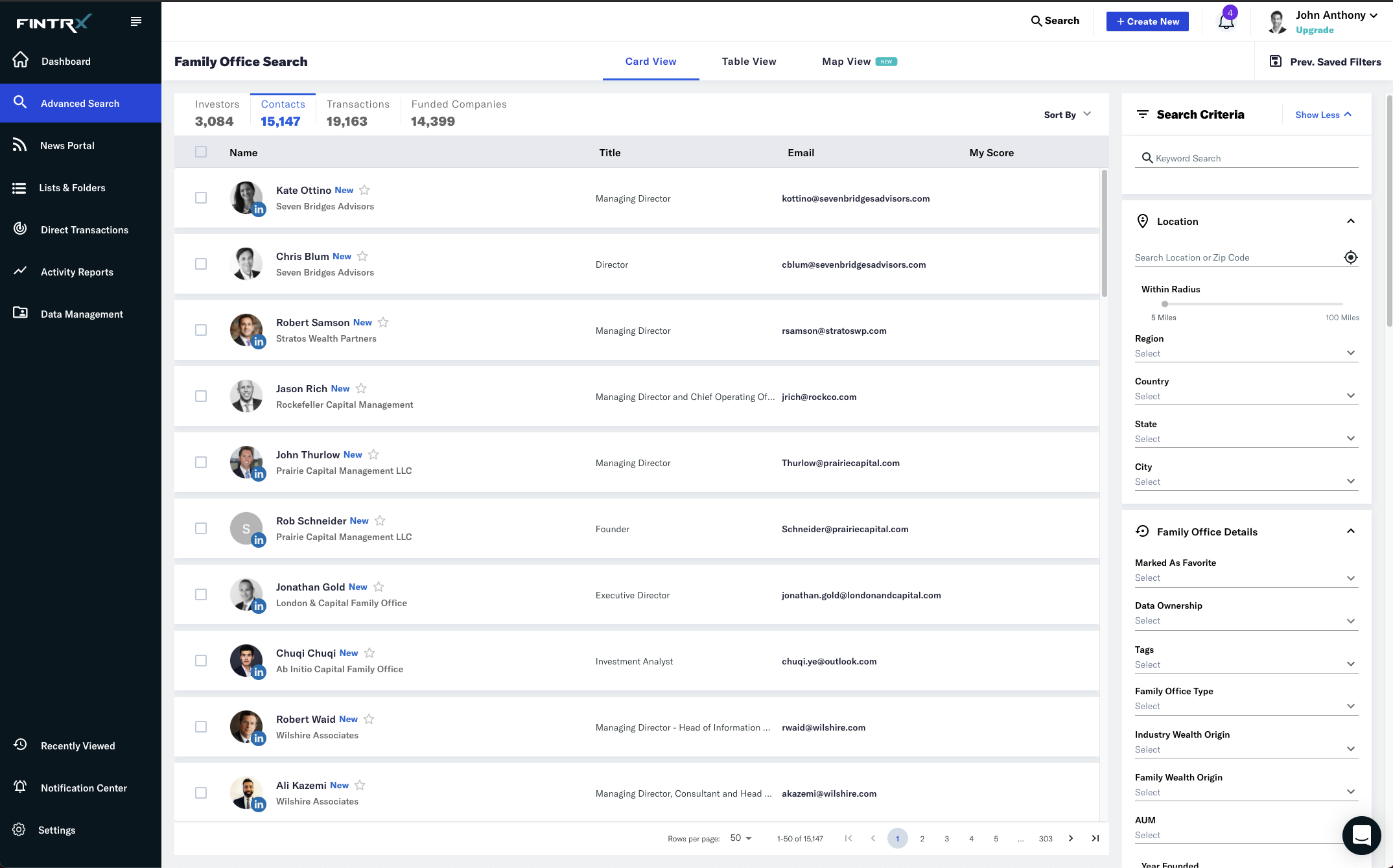

Family office & registered investment advisor data for

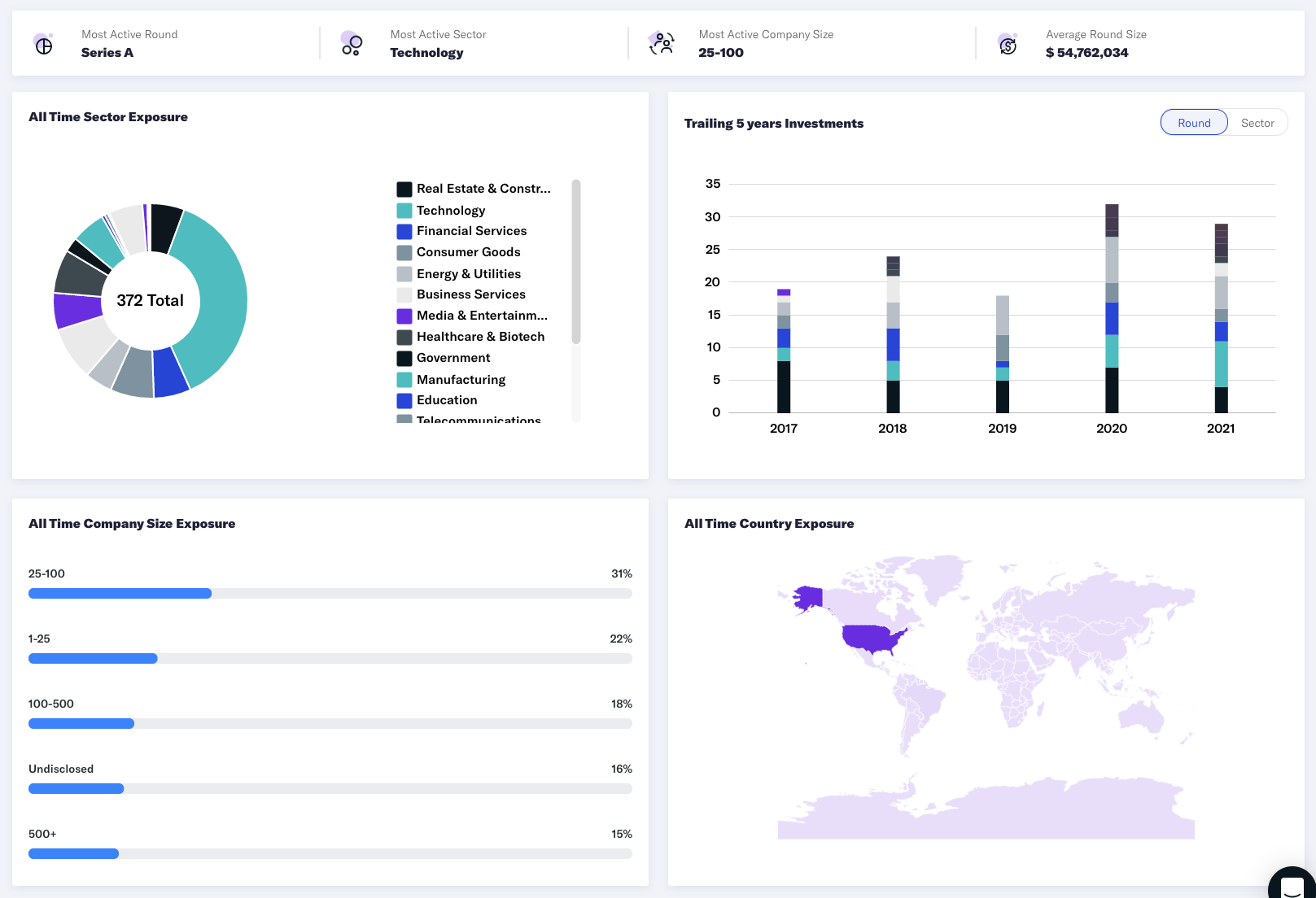

FINTRX lets you define what constitutes a core, power, and casual user, and conduct analysis on your own terms. Visualize differences in

Product Teams

Product Teams

Product Teams

REAL ESTATE

Efficiently Source Private Wealth Real Estate Investors

Family Office & RIA Data

Tailored For Real Estate Firms

Join the hundreds of real estate asset managers who trust our unparalleled data and intuitive prospect management tools to source private wealth investors.

Source Real Estate Direct Deal & Fund Investors

Save time by prospecting into the right allocators at the right time

Uncover LP's That Invest In Your Real Estate Strategy

Pinpoint the right LP's that have an interest in your real estate strategy

Access to Real Estate Research Decision Makers

Find and access the specific decision makers responsible for making new real estate investment decisions

Your Real Estate Fund Raising Questions Answered

FINTRX solves for critical questions, such as...

Which family offices invest in our real estate strategy?

Which RIA's allocate to our fund strategy?

Who has recently invested in

real estate funds like ours?

Who in my network can introduce me to the right real estate contacts?

Hear What Our Customers Have to Say

"As a long time Discovery Data user, FINTRX has been a breath of fresh air allowing us seamless access to investment advisor and registered rep data." - Jud Mackrill, Partner, Mammoth VC

"I have been very impressed with the quality of the FINTRX platform - no other platform has the breadth and depth of coverage of the global family office investor universe." - Will Dombrowski, Partner, Apis Capital

"FINTRX has allowed us to tap into the family office channel across our multiple strategies in a way we could not do until now. We have more than doubled our touchpoints with family offices across the United States since using FINTRX." - Michael Davis, NewSpring Capital

"Wonderful platform that has produced high-quality capital leads and has helped in building out our capital pipeline for existing and future investments." - Samantha Ory, Ouroboros Group

"To date, I have already received an investment from a family office that originated from FINTRX that I had no prior connection to whatsoever." - Kevin Gahwyler, Measure 8 Venture Partners

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)