Family Office & Registered Investment Advisor Data For

FINTRX provides accurate and comprehensive private wealth intelligence - empowering you to book more meetings, increase efficiency & expand your network.

See why thousands of financial professionals have ditched their legecy data providers and migrated to FINTRX...

Explore Our Data Intelligence Modules

FINTRX provides best-in-class data intelligence on the global private wealth ecosystem.

WHY FINTRX DATA?

Industry leading financial firms leverage our powerful algorithms and expansive research team to better access the complex and rapidly changing private wealth ecosystem.

Trusted by Industry Leaders

Meet a few of our trusted customers

Best in class asset managers and financial services firms lever FINTRX to map, access, and sell into the global family office & registered investment advisor ecosystem. Learn more below!

CUSTOMER CASE STUDY

Discover How Wells Fargo Leverages FINTRX to Efficiently Access the Family Office & Registered Investment Advisor Ecosystem.

"FINTRX has done the hard work identifying single & multi family offices across the world and the information FINTRX has is extremely difficult to find."

Thomas Gutterman, Wells Fargo

>> Read Case Study

PRIVATE WEALTH DATA INTELLIGENCE

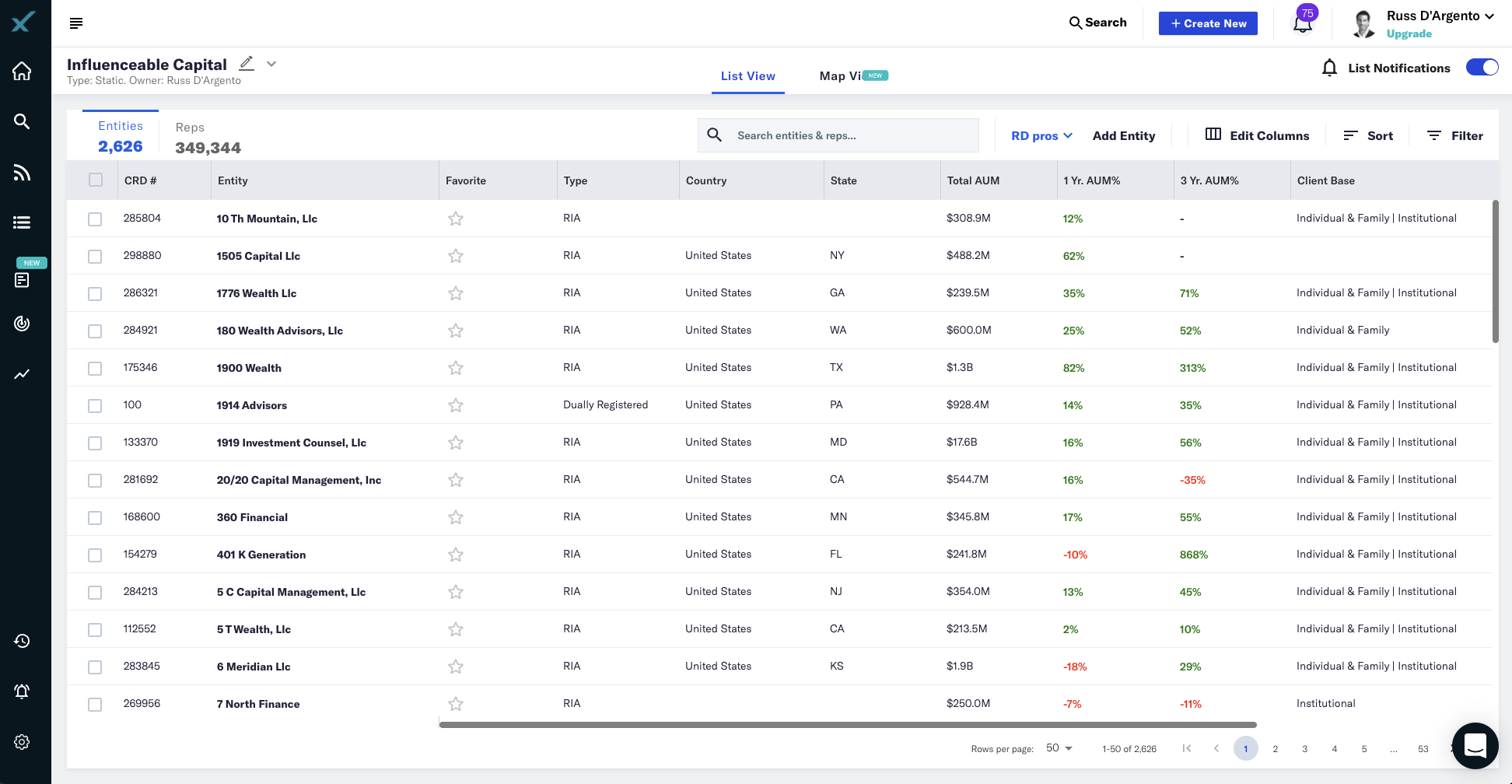

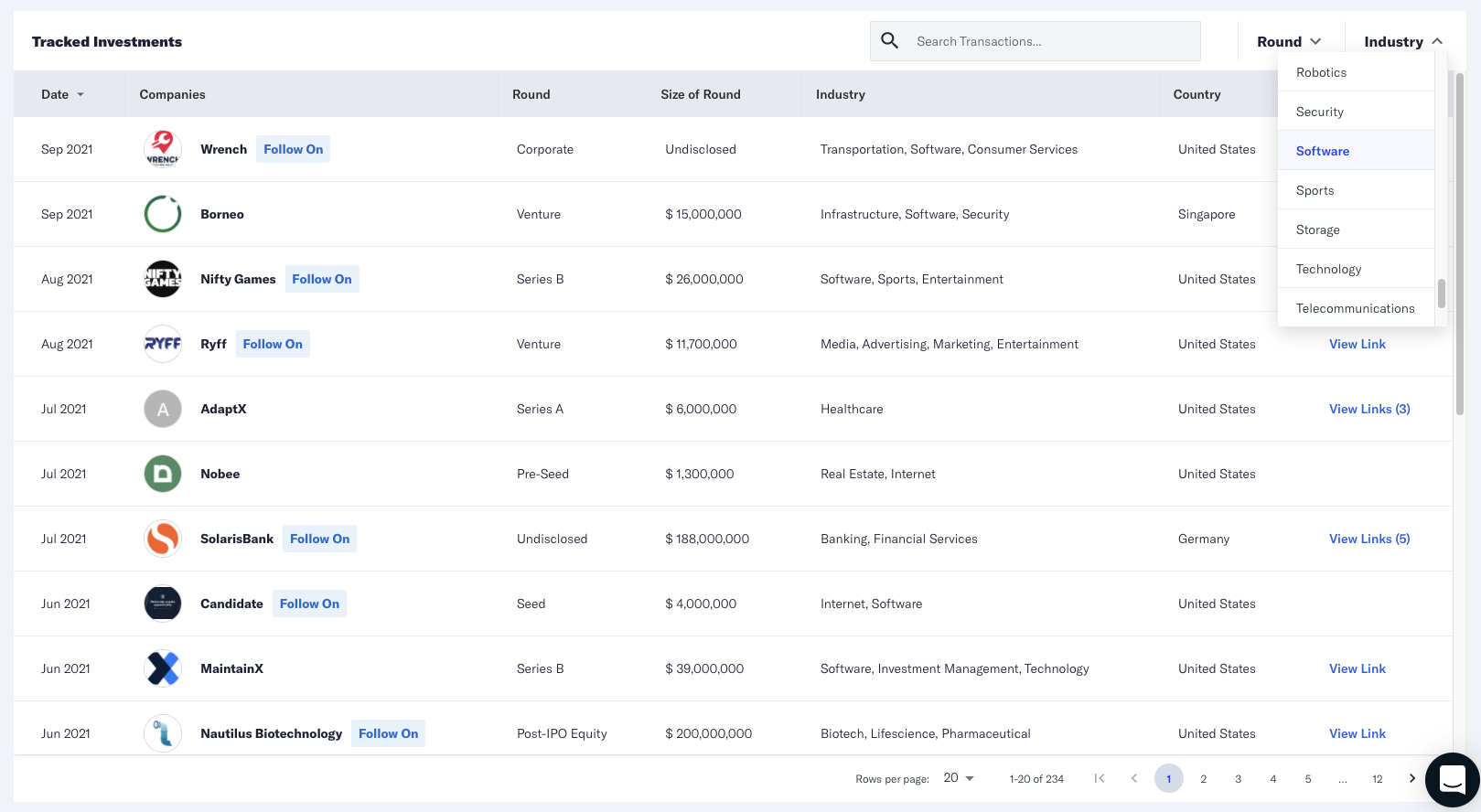

Identify, Access, & Sell Into Family Offices & Registered Investment Advisors

FINTRX offers comprehensive private wealth data intelligence on Family Offices and Registered Investment Advisors (RIA's). Our data ensures you have access to current and accurate information - driving more meetings, increased efficiency & growth for your business.

Data Points

3.3B

Searchable Fields

375

Family Office Records

40,000+

RIA & Broker Dealers

1.5M+

Direct Emails

650K+

Investable Assets

$115T

Monthly Updates

100K+

FINTRX Native Fields

75+

-1.png?width=480&height=442&name=RIA%20layered%20screens%204%20(1)-1.png)

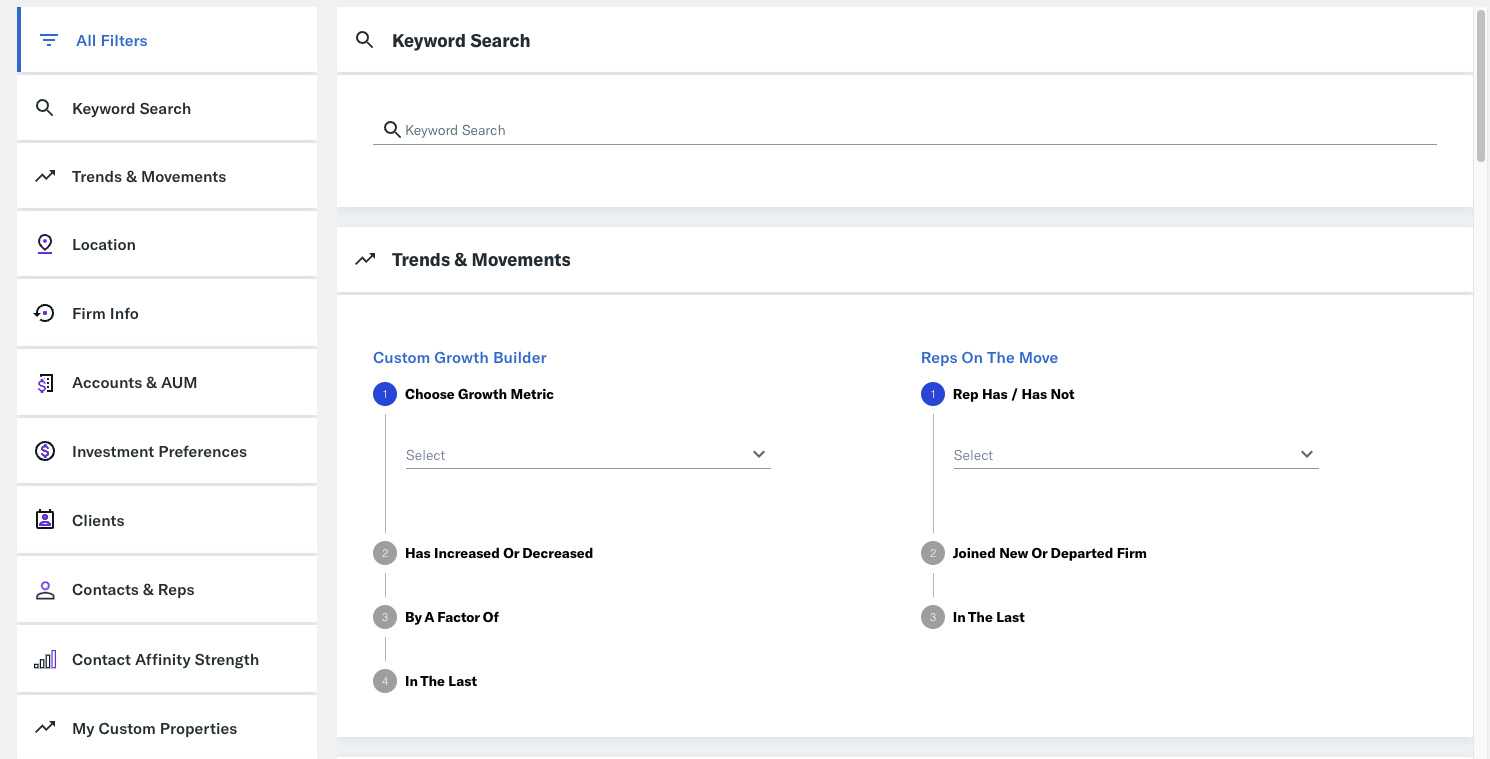

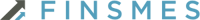

Powerful Yet User Friendly Interface

-

Access to 375+ advanced search filters and query options

Find relevant decision makers in a snap with powerful...

Find relevant decision makers in a snap with powerful search filters and queries. Uncover the data you need, when you need it. Filter through areas of investment interest, AUM, asset flows, intent signals, potential associates and more...

-

Smart lists keep your data accurate at all times

Use our Smart Lists technology to ensure your lists & data...

Use our Smart Lists technology to ensure your lists & data are kept accurate at all times. Sort and filter by hundreds of data points, monitor important updates, download custom exports and segment by territory.

-

Custom news alerts and notifications

Customized news alerts and notifications deliver actionable...

Customized news alerts and notifications deliver actionable and timely outreach triggers designed to put relevant news mentions and notable changes in your hands. Receive notifications within the FINTRX platform or via email so you never miss a thing.

Intelligent Private Wealth Data. Simplified.

Industry leading asset managers & financial service firms trust FINTRX to deliver best-in-class private wealth data.

Wells Fargo Case Study

See how Wells Fargo increased their family office coverage...

NewSpring Case Study

How NewSpring Capital leverages FINTRX to source family offices...

Ouroboros Case Study

See how the $4B Ouroboros Group sources families with FINTRX..

FINTRX In the Press

FINTRX Raises $9M in Series A Funding

Finsmes

More Wealthy Families Are Throwing a Lifeline...

New York Times

-2-1.png?width=130&height=19&length=200&name=Untitled-Project%20(6)-2-1.png)

Why Family Offices Are Chasing Direct Deals

Business Insider

Look beyond the label in choosing a modern...

Financial Times

6 Family Office Trends In Direct And Venture...

Forbes

Family Office Capital Pumps Up Private-Equity...

Wall Street Journal

Why the hubris of Indian family offices is raising...

Asian Investor

Billionaire Families Reshape Silicon Valley's...

Bloomberg

Family Office Increasing Direct Investments...

Charles Schwab

What are High-Net-Worth Individuals Investing in...

Motley Fool

Rising rich boost stature, growth of family offices

InvestmentNews

Direct Investing Is Rising Among Family Offices

PE Insights

Simplify your family office and registered investment advisor access

Book more meetings, increase efficiency, and expand your network

RESILIENCY

Since preparation is a key ingredient to success, our team focuses on resiliency and planning when it comes to customer data.

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

Get Our Daily Coronavirus Tracker Insights Sent to Your Inbox

.png?width=140&name=image%20(49).png)

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)