- Home

-

Data Modules

-

Why FINTRX

-

DATA FEATURES

-

ACCESS & INTEGRATIONS

-

-

Solutions

-

Resources

-

About

- Login

- Home

-

Data Modules

-

Why FINTRX

-

DATA FEATURES

-

ACCESS & INTEGRATIONS

-

-

Solutions

-

Resources

-

About

- Login

REQUEST TRIAL

Activate Below

Family Office & RIA Data Intelligence

A Better Way to Access Family Office & RIA Data

Discover how FINTRX empowers its customers to map, access and sell into the complex and fragmented world of Family Offices and Registered Investment Advisors.

Trusted By

Blog & Resources

NEWS AND INSIGHTS FROM FINTRX

Family Offices Continue Moving Towards Direct Investments

The Rise of Direct Investments Among Family Offices

The recent direct investment trend within the family office sector shows no sign of slowing down. The once passive and fund heavy family office has given way to its modern, more sophisticated offspring. The upshot in family offices 'going direct' offers a myriad of advantages to the underlying office. Lets unpack this a bit further...

- Increased control: Who doesn't like control? The modern, sophisticated family office seeks more than a passive stake. Many groups, (mainly single family offices) are after more than ROI. A seat at the table, allowing for value pass through is often equally as important in the private markets.

- Longer hold times: When compared to the rigid private equity fund structure approach, that seeks a 2-3x ROI within X time frame, a family office can offer substantial value. When going direct, most family offices are in it for the long haul, presenting their dollars as 'patient capital'. Why is this important? Patient capital aligns the best interest of all parties - operators & investors. The power of sticky long term capital can not be understated.

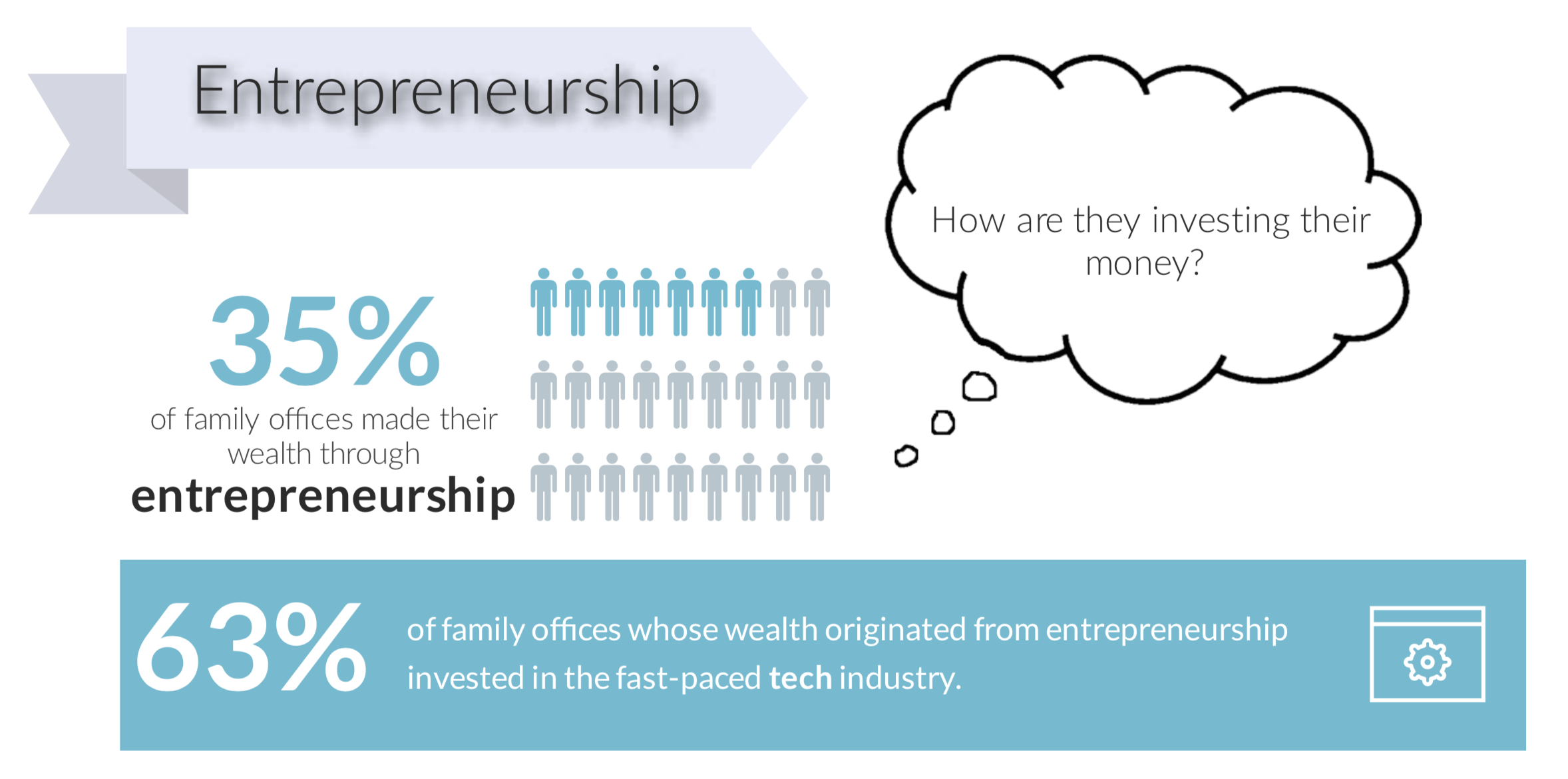

- Domain expertise: This may be the most important nugget. Domain expertise can be very powerful to the group receiving capital. Consider a single family office for which the family wealth was created in the tech space. When making a direct investment in a tech company, the comfort, industry insight, networking opportunities, amongst others are all pillars of added value the family office can offer the operator. In fact, a recent study sourced from our newly launched family office Buy-Side product, offers insight into family offices who's wealth was created from entrepreneurship & their correlated affinity to making direct technology investments. Lets have a look...

SOURCE : FINTRX DATABASE

SOURCE : FINTRX DATABASE

The trend in family offices going direct is here to say. Through my personal lens as an entrepreneur, the value of securing private wealth/family office capital makes perfect sense. Sticky, long term, patient capital, that can offer strategic value is a beautiful thing. It will certainly be interesting to track the continued flow of family offices making direct investments - & luckily for us, we do just that.

Until next time...

.png?width=367&height=109&name=ezgif.com-gif-maker%20(3).png)